Wine Australia has released an insightful report on the UK market, which remains Australia’s number one export market by volume. The report provides a detailed analysis of the current trends and challenges impacting wine consumption in the UK, such as economic shifts, inflation, changes in disposable income and evolving consumer behaviour.

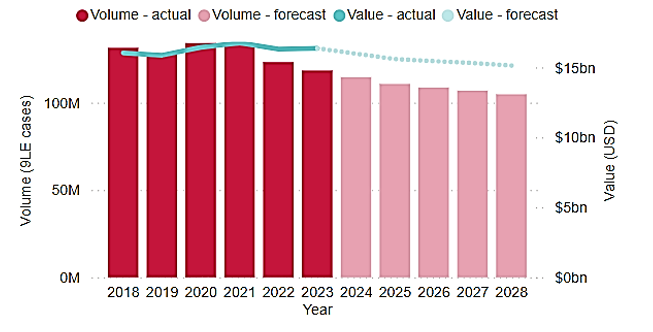

The UK economy has experienced volatility, including a recession in 2023 due to high inflation and interest rates. Although inflation has begun to ease, household disposable incomes remain low, negatively impacting consumer spending. As alcohol prices rose, wine consumption declined, with the volume of alcohol consumption in the UK falling by 2% in 2023. Wine and spirits were the most affected, seeing a 4% year-on-year decline, exacerbated by rising costs and the closure of on-premise venues.

A new alcohol taxation regime, introduced in August 2023, further increased prices for wines with higher alcohol content. The new tax system has driven some growth in the lower-alcohol wine segment, and it is expected to encourage further development of such products to benefit from lower tax rates.

Despite the decline in volume, the number of wine drinkers in the UK has grown by 9% since 2019, leading to a drop in per capita consumption. Consumers are moderating their alcohol intake, with the trend towards no- or low-alcohol wine gaining momentum, particularly with no-alcohol options, which now dominate this segment. Off-premise wine consumption remains higher than pre-pandemic levels, while on-premise consumption continues to struggle, partly due to rising costs and closures of licensed venues.

Australian wine exports to the UK have been affected by these changes, as well as by the UK’s departure from the EU and the COVID-19 pandemic. The Australia-UK Free Trade Agreement in 2023 eliminated import tariffs on Australian wines, but the impact of this has been offset by increased duties under the new alcohol tax system.