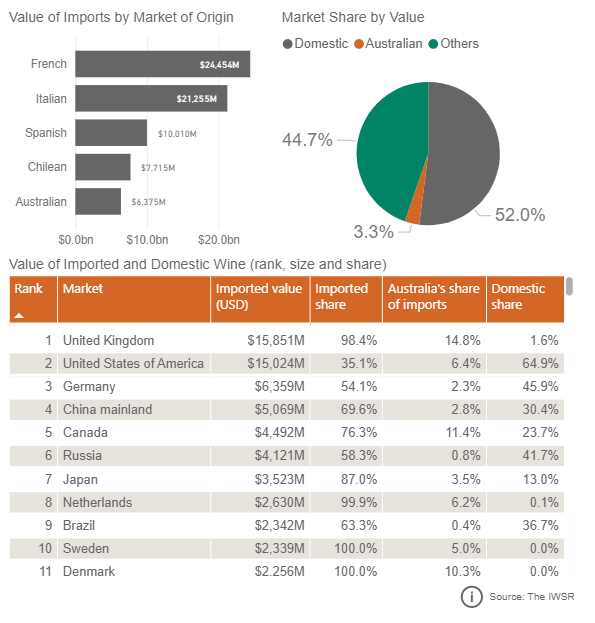

Wine Australia’s Market Explorer provides fascinating insights into the global wine market, revealing not just how different countries consume wine, but also the nuances of the market shares.

The data paints a picture of the dominance of domestic wines globally, holding a majority market share of 52%. This suggests a prevalent preference for locally produced wines over imported ones.

When it comes to exported wines, France leads, boasting a value significantly higher than other countries. It’s followed by Italy, Spain, Chile and then Australia. Interestingly, my home country, the United Kingdom emerges as the top market for Australian wine imports, holding a large 98.4% share of imports, highlighting the UK’s strong inclination towards foreign wines.

The United States presents a different scenario, with a larger domestic share of 64.9% compared to its imported share. This variation in import shares is a common theme across different markets. For instance, Australia’s share of imports fluctuates dramatically, ranging from 14.8% in the UK to as low as 0.4% in Brazil. These variations underscore the diverse positioning and competitiveness of Australian wine in the global arena.

Alongside these market dynamics, the data also sheds light on the patterns of wine consumption in terms of settings – on-premise (like bars and restaurants) versus off-premise (such as homes ). There’s a marked preference for off-premise wine consumption, accounting for 78.1% of the total, compared to 21.9% on-premise.

The United States leads in total wine consumption volume but has a lower percentage of on-premise consumption compared to off-premise. In contrast, Italy shows a more balanced approach between on-premise and off-premise consumption. The UK, ranking fifth in overall consumption, exhibits one of the highest rates of off-premise consumption at 90.2%.