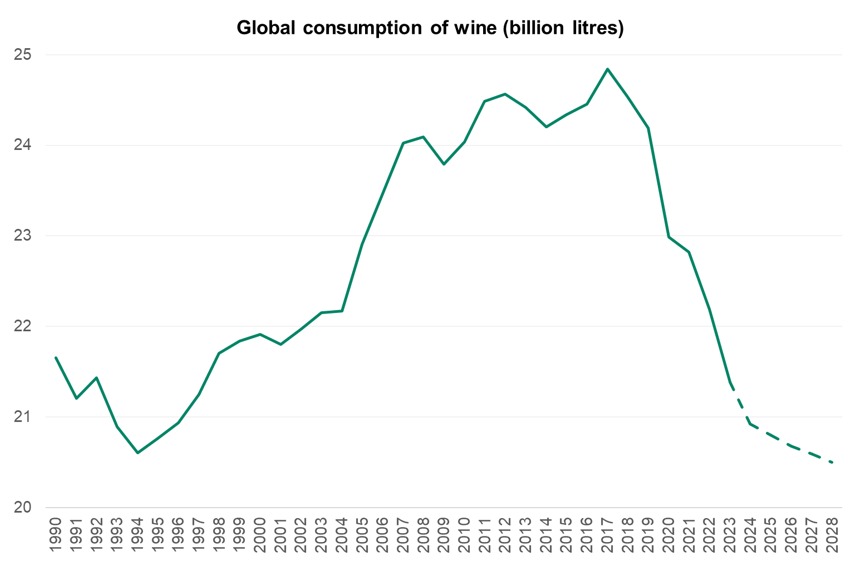

Wine Australia’s latest Market Bulletin explores a significant global trend in the wine industry: a consistent and widespread decline in wine consumption over recent years. Between 2018 and 2023, global consumption dropped by around 3.1 billion litres, equivalent to approximately 31 billion standard glasses of wine. This pattern of reduction is not limited to one region but is evident across a range of mature and emerging wine markets. Forecasts suggest that if current trends continue, a further billion litres could be lost by 2028, which would amount to a total decline of around 20 percent over a ten-year period.

Source: IWSR

The decline is attributed mainly to demographic and behavioural shifts. The global population of regular wine drinkers is not only shrinking but those who continue to drink wine are consuming less. Younger consumers are generally less engaged with wine than previous generations, showing a preference for a broader variety of alcoholic and non-alcoholic beverages. This generational shift is happening alongside greater health consciousness, lifestyle changes, and economic pressures, all of which influence alcohol consumption habits.

Notably, three major markets, the United States, the United Kingdom, and China, have experienced a marked reduction in the number of wine drinkers. In these countries, the drop in consumption reflects broader global patterns and is particularly concerning given their importance to the global wine trade. Wine is increasingly facing stiff competition from other categories, such as craft spirits, ready-to-drink products, and low- or no-alcohol alternatives, which are growing in popularity across a wide consumer base.

The bulletin highlights that while these changes present significant challenges for producers and exporters, they also offer an opportunity to adapt and innovate. The wine industry may need to rethink traditional marketing strategies and product offerings, focusing more on premiumisation, sustainability, health-oriented products and engaging storytelling to connect with evolving consumer values. As consumption patterns shift, success in the global wine market will depend on how effectively producers respond to these cultural, economic and generational transformations.