A new report provides insights into Australian wine exports for the year ending December 2024. A significant theme was the surge in exports to mainland China following the removal of import tariffs in March 2024, which drove a 34% increase in export value to AUD 2.55 billion and a 7% rise in volume to 649 million litres. Exports to China alone accounted for AUD 902 million in value and 83 million litres in volume. However, exports to other global markets, including the UK, declined.

Focusing on the UK, Australian wine exports showed relative stability after previous disruptions caused by Brexit and the COVID-19 pandemic. The UK remained Australia’s second-largest export market by value, though shipments fell by 3% in value to AUD 352 million and 4% in volume to 212 million litres. The UK remains a dominant market for bulk wine, with 89% of Australian wine exported there being unpackaged and bottled locally. The average export price increased slightly to AUD 1.66 per litre.

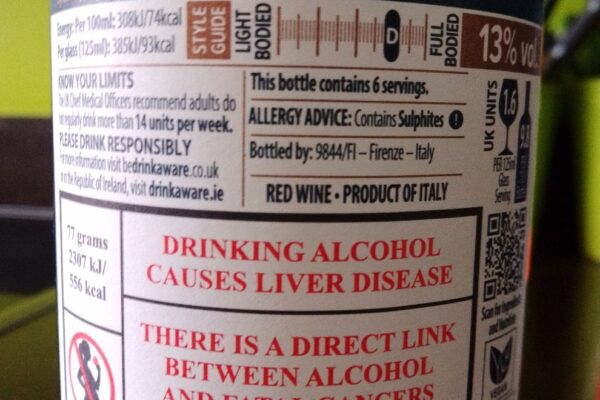

Consumer spending in the UK remains constrained, with inflation easing but still influencing purchasing behaviour. A significant factor going forward is the alcohol duty reform, which will introduce over 30 different tax rates depending on alcohol content. This has already led Australian producers to adjust alcohol levels in their products, with an increase in wines below 11.5% ABV.

Red and rosé wine exports to the UK declined by 4% in value and volume, with Shiraz, Merlot and Cabernet Sauvignon leading the decline. White wine exports also fell, with Chardonnay, Sauvignon Blanc and Colombard recording decreases. While exports of sparkling white wine increased, it was not enough to offset declines in still white wine.

In contrast to the UK, European markets outside the UK saw an 8% decline in export value, with Germany and the Netherlands experiencing significant drops, while Belgium and Sweden posted some growth. The wider European market remains affected by economic uncertainty, inflation and changing trade patterns, particularly in re-export hubs like Belgium and the Netherlands.

Overall, while Australian wine exports to China rebounded strongly, other global markets, including the UK, showed mixed results, with economic pressures and regulatory changes shaping the outlook. The UK market remains crucial for bulk wine but faces challenges related to duty reforms and shifting consumer spending habits.