I keep track of all the supermarket websites to find wines for my offers page. Something that has been quietly added at Tesco is the integration of online third-party marketplace sellers to include wine.

Tesco relaunched its general online marketplace in June 2024, allowing shoppers to buy thousands of non-grocery products from approved partners alongside their usual food shop on Tesco.com. This sits within the groceries site, with a dedicated Marketplace section covering categories such as homeware, garden, DIY, toys, baby, pet care, electronics and more. At launch there were around 9,000 listings, but by January 2025 the number had grown to more than 300,000 SKUs, showing rapid expansion. Wine is now part of this extended offer.

This is a very different model from Tesco Direct, the standalone non-food site that closed in 2018. Marketplace is an extension platform hosted on Tesco.com, rather than Tesco buying and holding stock itself. Customers can collect Clubcard points on Marketplace purchases, but orders, delivery and most service interactions are handled by the third-party seller rather than Tesco directly.

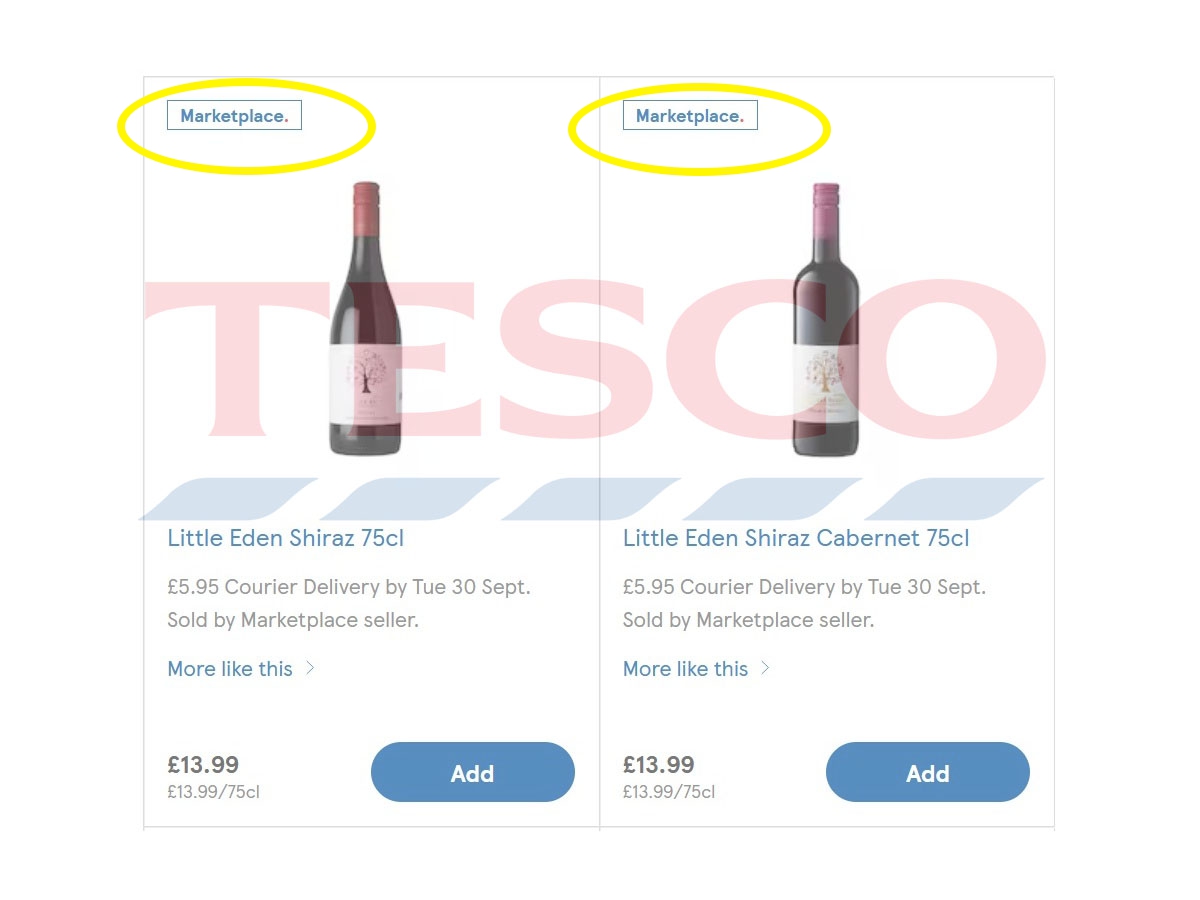

Browsing Tesco.com now, the wine aisle shows a mix of Tesco and Marketplace products, with Marketplace wines clearly flagged. These display courier delivery dates and fees set by the seller, rather than aligning with Tesco’s grocery delivery slots. That represents a shift from the old model, where every bottle came via Tesco’s own fulfilment.

Among the wine sellers currently trading through the Marketplace are Drayman Direct, part of Beviqua and already active on Amazon, eBay and OnBuy, along with Liquor Library Ltd, Drinx.com and DS Drinks.

For customers, the immediate benefit is the wider range. Marketplace adds thousands of extra wine SKUs, including cases, unusual formats and niche labels you would not normally see in a Tesco store or within the core Tesco.com range. I even saw some branded wines I knew as being listed at other supermarkets. However, most Marketplace wines seem to be more premium offerings.

The Marketplace split is made clear on the listings page. This creates more scope for discovery, seasonal gifting and topping up with specialist bottles. The trade-off is in service: Marketplace wines are delivered separately by post or courier, with their own fees and timeframes, and cannot be combined with a grocery delivery or Click+Collect. Returns are managed with the seller under Tesco’s Marketplace promise, and queries about delivery also go through the seller. Clubcard points remain available, but pricing and promotions on Marketplace items do not align with Tesco’s Clubcard Prices.

For Tesco, the advantage is clear. It can dramatically expand its online wine offer without tying up working capital or warehouse capacity, while still capturing sales, basket breadth and Clubcard engagement. The company also earns commission from partners, and has already highlighted in its FY24/25 results that Marketplace has supported overall online growth. The risk lies in brand control, as the delivery experience, service quality and price perception are shaped by multiple partners, in what is a sensitive, age-restricted category. There is also a risk of customer confusion around promotions, offers and what’s in store.

In short, Marketplace gives Tesco a way to make margin on a far greater range, even if some individual items, indeed much like some of their own, offer only slim returns. It seems to extend Tesco’s strategy of moving into higher-end and long-tail categories while the wider market remains weak, strengthening its overall position and share of the wine sector.

One last thought. Is this a threat or opportunity for independent wine retailers? Tesco’s Marketplace offers independent wine retailers a route to reach its huge online grocery audience without the costs of acquiring traffic themselves. It might work well for those with niche, high-margin or exclusive stock such as mixed cases, unusual formats or producer exclusives. Because independents already operate on slim margins, the extra costs of commission, packaging, courier charges and the risk of breakages or returns could easily wipe out profit. Marketplace therefore makes sense only for carefully selected, ring-fenced ranges with enough margin to absorb the costs, while for retailers whose edge is local service or whose wines are already price-sensitive, joining could erode their brand and financial sustainability. Added to this, the typical independent’s customer is perhaps unlikely to have significant crossover with Tesco’s, raising questions about whether the exposure would bring in genuinely valuable new buyers.